How to check shares transferred to IEPF ( Investor Education Protection Fund )?

Let us first describe why your shares were moved to IEPF before we discuss the procedure for how to check shares transferred to IEPF.

In the following circumstances, shares can be transferred to the IEPF (Investor Education and Protection Fund):

1) Unclaimed dividends: If a shareholder fails to claim their unclaimed dividend for seven years in a row, the dividend is transferred to the IEPF.

2) Unclaimed shares: If a shareholder does not claim his or her shares or rights for seven years in a row, the shares are transferred to the IEPF.

3) Inactive accounts: If a shareholder’s account has been inactive for seven years in a row and the company has been unable to contact the shareholder or their nominee, the shares are transferred to the IEPF.

4) Dormant companies: If a company has been dormant for seven years and has failed to meet legislative requirements such as having annual general meetings and filing financial statements, its shares may be transferred to the IEPF.

The Indian government formed the IEPF to protect the interests of investors and to encourage investor education. When shares are transferred to the IEPF, the shareholder loses ownership of the shares and the IEPF becomes the legal owner. Nonetheless, the shareholder can still claim their shares from the IEPF by following the IEPF’s procedures.

Now let us know how to check shares transferred to IEPF.

It is possible that the procedure for examining shares that have been transferred to the Investor Education and Protection Fund (IEPF) will change in accordance with the particular circumstances surrounding the transfer. Nevertheless, the following is a list of some generic measures you can follow:

Procedure A

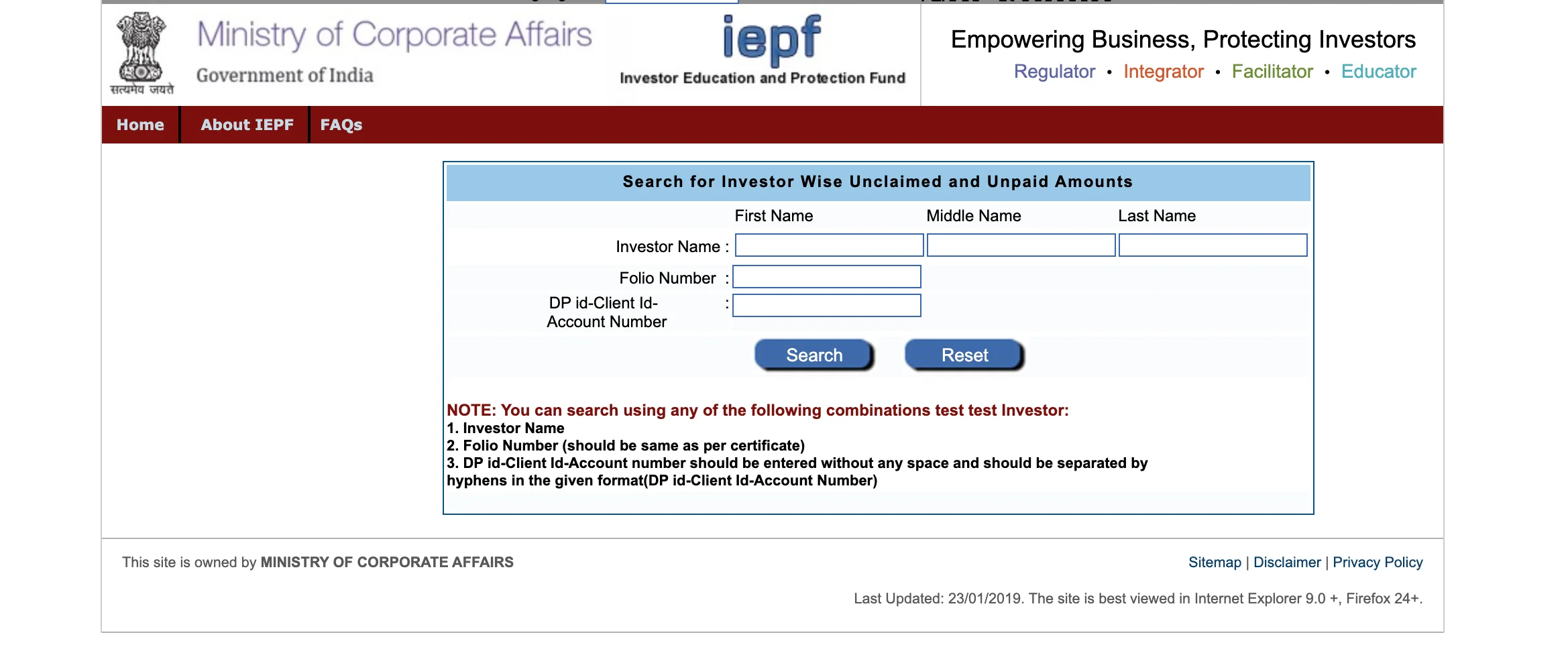

In order to know how to check shares transferred to IEPF and the IEPF refund process, you can go to the website of the Ministry of Corporate Affairs (MCA), which can be found at https://www.iepf.gov.in/IEPF/refund.html.

1. Click on the “Search IEPF Refund Claims” button on the homepage.

2. Provide the necessary information, which may include your company’s name, the Permanent Account Number (PAN), the folio number, and/or the Investor Name.

3. Click on the “Search” button to see the results.

Procedure B

Another way to know how to check shares transferred to IEPF, You can have the option of checking with the company whose shares you own, the company’s registrar, or the company’s transfer agent. These are your other options. You can contact via email or phone.

It is possible that they will be able to give you information regarding the transfer of shares to the IEPF. It is crucial to note that shares are normally only transferred to the IEPF in situations when the dividends or other corporate advantages associated to the shares remain unclaimed for a particular amount of time. This is a condition that must be met before shares may be transferred. If you believe that your shares have been transferred to the IEPF but you have not yet claimed them, you can claim your shares by following the process that is detailed on the IEPF website. If you have any questions, please contact the IEPF.

In case your shares have been transferred to IEPF and you are facing difficulty in claiming them, you can contact iefpzone.com.